Management Discussion and Analysis

Customer Capital

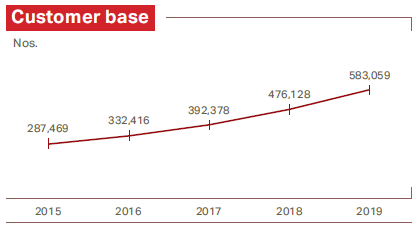

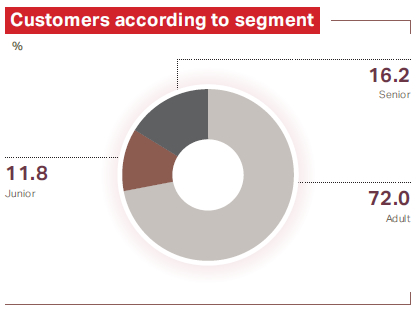

Since our inception, we have established meaningful relationships with our customers which is the secret of our success. With almost half a million accounts, our customers come from all segments of Sri Lankan society and we hope to inspire them to reach their goals by providing them with the necessary tools for financial management.

We have outlined customer centricity in Vision 2025 as one of our strategic pillars in the journey to reach two million customers. Through multiple approaches, innovative products, and internal improvements in 2019, we enhanced customer experience. We work closely with our customers and constantly develop their offering through innovation to increase their satisfaction and experience.

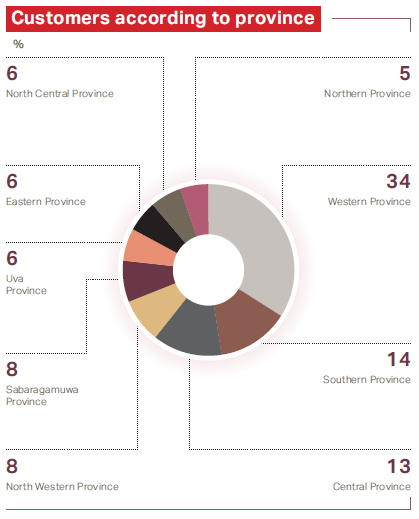

Customer profile

Our product portfolio

Credit line/Subsidy scheme supported project loans

Prosperity Loan Scheme (“Saubhagya”)

for Small and Medium Enterprises (SMEs)

Small and Micro Industries Leader and Entrepreneur Promotion Project III Revolving Fund (“SMILE III RF”)

for SMEs

Small and Medium-Sized Enterprises Line of Credit – (“SMELoC”)

for SMEs

Micro and Small Enterprises Development Loan Scheme (“Swashakthi”)

for Micro and Small Enterprises

Loan Scheme for Resumption of Economic Activities affected by Disasters (READ) (“Athwela”)

for small-scale businesses affected by a disaster

Environmentally Friendly Solutions Fund II – Revolving Fund (“E-friends II RF”)

for pollution reduction and efficiency improvement initiatives

Smallholder Agribusiness Partnership Programme (“SAPP”)

for out-grower farmers and youth entrepreneurs connected to the agriculture value chain

Rooftop Solar Power Generation Line of Credit (RSPGLoC)

for rooftop solar power systems of up to 50 kW

New Comprehensive Rural Credit Scheme (NCRCS)

for short-term cultivation

Other project loans

Term loans

for corporates, SMEs, professionals and individuals

DFCC credit card

The only Credit Card that offers 1% Cashback on every swipe

for corporates, self-employed individuals, professionals and salaried individuals

Working capital financing

Short-term working capital financing – overdrafts, revolving credit or short-term working capital loans

for corporates, SMEs, entrepreneurs and current account holders

Medium, long-term loans to finance permanent working capital requirements

for corporates, SMEs and entrepreneurs

DFCC Sahaya

A one-stop financial solution offering loans, leases, bank guarantees and other commercial facilities

for MSMEs

Leasing facilities

DFCC Leasing for brand new and unregistered/registered vehicles, machinery, plant and equipment

for corporates, SMEs, entrepreneurs, professionals and individuals

Hire purchase facilities

Hire purchase facilities for vehicles

for corporates, SMEs, entrepreneurs, professionals and individuals

Guarantee facilities

Bid bonds, advance payment bonds, performance bonds, bank guarantees for credit purchase of goods

for corporates, SMEs, entrepreneurs, professionals and individuals

Time deposits

A wide range of tailor-made time deposit products at competitive interest rates

for corporates, SMEs and individuals

Loan syndication

Loans provided by a group of lenders which is structured, arranged and administered by one or several banks

for corporates

Consultancy and advisory services

Provision of legal, tax, finance, market and other advisory services to start up a new business or revamp existing businesses

for corporates, SMEs and entrepreneurs

Savings accounts

Supreme Vaasi – Offers a superior rate of interest

for businesses and individuals aged 18 years and above

Mega Bonus – Interest rates grow in tandem with the savings deposits

for businesses and individuals aged 18 years and above

Xtreme Saver – Offers the highest interest rate for Rupee and Dollar denominated savings based on the account balance

for businesses and individuals aged 18 years and above

DFCC Winner – Offers the best interest rate for accounts with a minimum balance of LKR 2,500.00 and above

for individuals aged 18 years and above

DFCC Junior – Children’s savings account offering a range of gifts and support for higher education

for children below 18 years of age

DFCC Junior Plus – Children’s savings account with a higher interest rate

for children below 18 years of age

DFCC Garusaru – Offers an attractive interest rate with a range of other benefits

for senior citizens above 60 years of age

Personal loans

Loans that help meet personal financing requirements

for salaried employees, professionals, and salaried individuals

Pawning services

Ranwarama Pawning – Gold-pledged advances

for the mass market/individuals

Housing loans

DFCC Home Loans – Flexible and convenient housing loans at affordable rates

for self-employed individuals, professionals, and salaried individuals

Education loans

DFCC Education Loans – Flexible and convenient loan facilities for higher education

for individuals pursuing higher studies

Garusaru Personal Loans – Special personal loan scheme

for government pensioners

Digital products and services

DFCC Virtual Wallet

DFCC iConnect

Mteller

Premier Go

eStatements

SMS alerts

Internet banking

DFCC MySpace

for corporates, SMEs, entrepreneurs, professionals, and individuals

Bancassurance

for corporates, SMEs, entrepreneurs, professionals, and individuals

Other services

Includes current accounts, overdraft facilities, foreign currency accounts, international trade services, off-shore banking, international payments, foreign money transfer via Western Union/Lanka Money Transfer and local payments.

for the business community, entrepreneurs, professionals and individuals

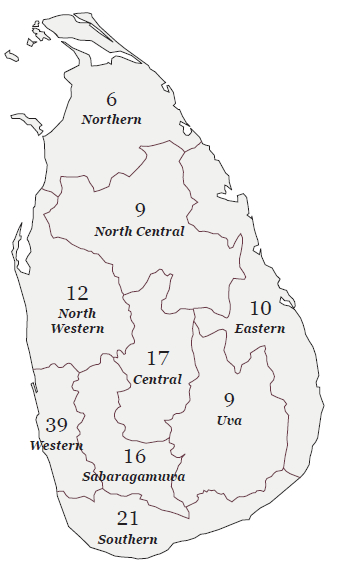

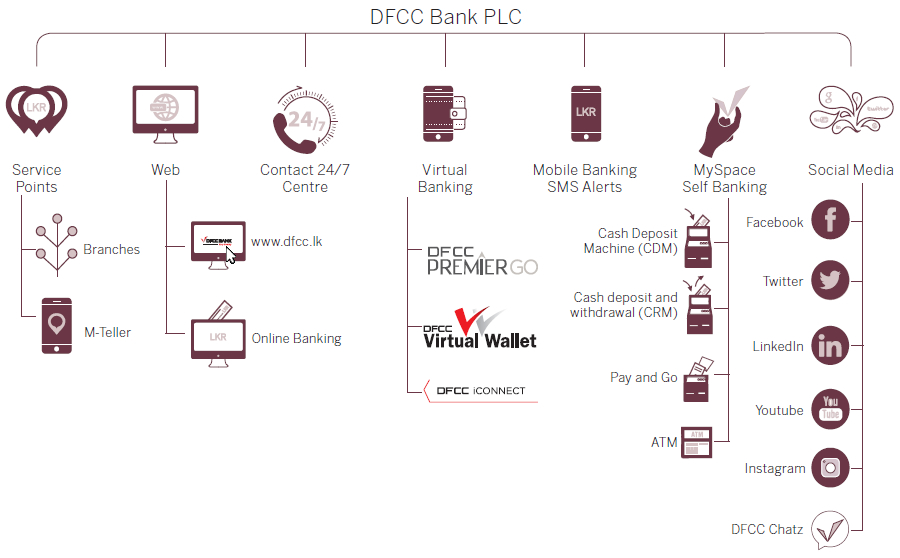

Branch network and service delivery

We expanded our reach in 2019 by establishing the Fort Super Grade branch. 27 post office customer service units were converted to fully-fledged branches. (Kuruvita, Kekirawa, Minuwangoda, Agalawatta, Athurugiriya, Beliatta, Rambukkana, Dickwella, Karandeniya, Mahaoya, Uhana, Aluthgama, Baduraliya, Bibila, Hakmana, Haputale, Homagama, Kottegoda, Naula, Puttalam, Ratnapura, Rattota, Uragasmanhandiya, Veyangoda, Warakapola, Wathugedara, Welikanda).

Customers also have access to the Bank’s services through over 4,500 ATMs across the island. The Bank embraces technology in expanding its reach to customers outside of the traditional brick and mortar via Internet and mobile banking services. Customers also have access to the Bank through its 24/7 Contact Centre and the website. The website was also revamped during the year. Customers from all corners of the island can now access the website in English, Sinhala, and Tamil.

New products and services in 2019

DFCC Winner savings account

DFCC Winner savings account offers Sri Lanka’s best interest rate for savings for individuals over 18 years. This product was launched in 2019 to encourage individuals, especially youth, to foster a culture of savings at an early stage in life.

MySpace digital banking services

In our commitment to provide a frictionless banking experience employing the latest technological advancement of the sector, we introduced, DFCC MySpace a bespoke space for banking services in 2019. The self banking solution is the consolidated digitalised service delivery space where our customers could experience those digital platforms 365 days 24×7.

The screens of these machines have been standardised creating an omni-channel experience and will facilitate an array of new innovative lifestyle based services. This initiative will enhance convenience and customer satisfaction.

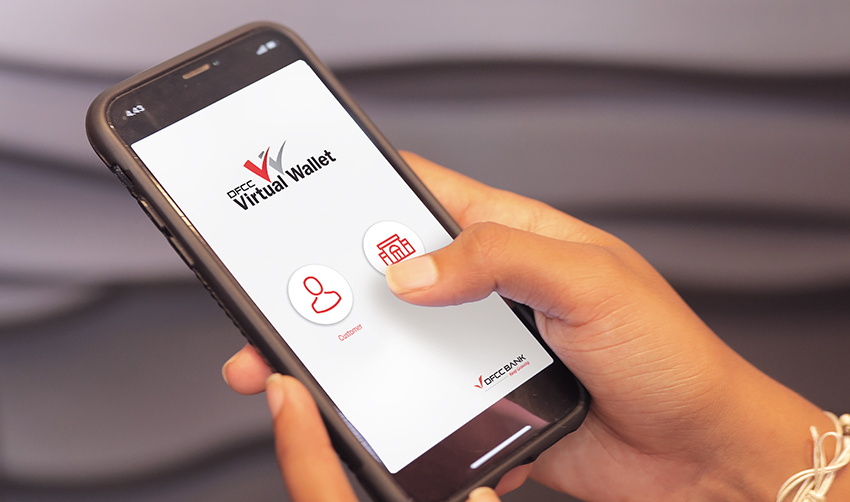

DFCC Bank Virtual Wallet and website revamped

To increase accessibility to our customers who come from all segments of society and geographical locations in Sri Lanka, we revamped the Virtual Wallet and our website. Customers can now access these service in all three national languages.

We reach our customers through Internet and mobile-centric digital touchpoints. In 2019, we revamped the Virtual Wallet and our Corporate Website to facilitate an enhanced customer experience.

Customer centricity

Under our ambitious Vision 2025, enhancing customer centricity is one of the three strategic pillars. It is intrinsically linked to our four long-term objectives of reaching two million customers and to become the most customer-centric bank in Sri Lanka. Segmenting SME/Retail customers to identify different value propositions and designing targeted marketing campaigns, designing bundled products and initiatives for SME, and establishing a BI Unit are some of the focus areas of action with a view to enhancing customer centricity. We also aim to win customers with quality, cost, and innovation.

The following initiatives were implemented during the year to enhance customer centricity:

- Establishing the Customer Experience Unit for the Bank

- Commencing a Mystery Call programme across the entire branch network

- Introducing a Customer Centricity session in the orientation programme for new recruits

- Branch visits for observation of service standards

- Branch trainings when service gaps are identified

- Mystery shopper programme across the entire branch network

- Identifying required process improvements

- Centralisation of complaint and inquiry handling

- Customer centricity and customer service refresher trainings to front office and back office staff

- Expansion of the Bank Contact Centre

Our employees are critical to the realisation of our objectives. Consequently, the HR Department along with the Customer Experience Unit has designed bespoke training programmes to inculcate the necessary values related to customer service, business etiquette, and customer centricity to our employees.

| Category | Participant count | Percentage |

| Customer service | 453 | 22.1 |

| Business etiquette | 439 | 21.4 |

| Customer centricity and customer service | 1,159 | 56.5 |

| Total Staff | 2,051 | 100 |

Customer privacy

We consider the privacy of our customers to be of utmost importance and make every effort to protect it. We utilise the latest digital infrastructure to secure our systems and processes and banking transactions. Customer privacy is an integral part of the Employee Code of Conduct, ensuring that employees understand the importance of protecting the privacy of their customers and play their part in upholding the secure systems and procedures of the Bank.

Multi-channel customer touchpoints

We reach our customers through an extensive network of touchpoints ranging from conventional branch network to Internet and mobile-centric digital banking solutions that include DFCC MySpace, DFCC Virtual Wallet, Premier Go, and DFCC iConnect. While many customers prefer to bank via conventional means for the human touch, upcoming generations of customers demand a virtual banking experience.

Product responsibility

Our approach towards product responsibility starts at the initial stages of designing new products. We strive to be ethical adhering to all necessary compliance requirements before introducing a new product to our customers. We understand that the modern customer is not only concerned with quality and service. Customers wish to be well-informed before making a purchase or starting a business relationship with a corporate entity.

DFCC Bank takes this responsibility seriously by providing transparent and relevant information to its customers. Information about products and services are available in all three languages and employees are available to provide more information where necessary. The Bank also conducts events across the country to educate current and potential customers about its products and services.

Marketing communications

We engage with customers and potential customers over multiple channels in English, Sinhala, and Tamil. A Board-approved Corporate Communications Policy and Social Media Policy defines how the Bank engages with customers and we work to ensure that information is accurate and complies with those policies, the Central Bank of Sri Lanka and the Bank’s Customer Charter.

We carried out various brand-building initiatives during 2019 such as marketing and seasonal campaigns, event sponsorships, and customer engagement activities.

Customer satisfaction and complaint handling

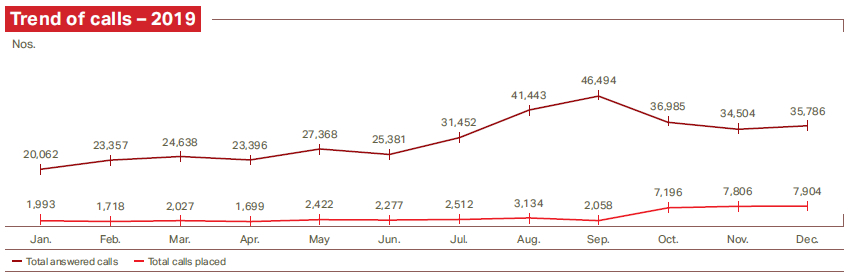

As the first contact point for customers who call the Bank, the Contact Centre provides an important service at the Bank and operates under the Customer Experience Unit Department. The Contact Centre conducts inbound and outbound functions 24 hours, seven days a week to ensure the smooth functioning of the Bank’s operations.

|

412,819 |

42,746 |

633 |

|

Total number of inbound calls |

Total number of outbound calls |

Non-voice requests* |

*Chat service was implemented in September 2019

Inbound

| Jan. | Feb. | Mar. | Apr. | May | Jun. | Jul. | Aug. | Sep. | Oct. | Nov. | Dec. | |

| Total queued calls | 24,438 | 28,361 | 28,030 | 25,181 | 31,620 | 30,909 | 34,446 | 45,486 | 51,188 | 38,711 | 37,290 | 37,159 |

| Total answered calls | 20,062 | 23,357 | 24,638 | 23,396 | 27,368 | 25,381 | 31,452 | 41,443 | 46,494 | 36,985 | 34,504 | 35,786 |

| Average answered calls per day | 647 | 834 | 819 | 744 | 892 | 876 | 1,003 | 1,371 | 1,558 | 1,180 | 1,121 | 1,147 |

| Average talk time (MM.SS) | 1.52 | 1.36 | 1.35 | 1.38 | 1.54 | 2.24 | 2.32 | 2.31 | 2.36 | 2.37 | 2.43 | 2.36 |

| Average ACW time (MM.SS) | 10.17 | 11.46 | 12.06 | 11.02 | 10.09 | 10.55 | 12.39 | 13 | 12.16 | 11.17 | 10.18 | 10.25 |

| Average answer time (MM.SS) | 0.35 | 0.40 | 0.39 | 0.38 | 0.38 | 0.32 | 0.33 | 0.39 | 0.37 | 0.30 | 0.28 | 0.29 |

Outbound

| Jan. | Feb. | Mar. | Apr. | May | Jun. | Jul. | Aug. | Sep. | Oct. | Nov. | Dec. | |

| Total calls placed | 1,993 | 1,718 | 2,027 | 1,699 | 2,422 | 2,277 | 2,512 | 3,134 | 2,058 | 7,196 | 7,806 | 7,904 |

| Average calls placed per day (Weekdays) | 101 | 86 | 101 | 85 | 121 | 114 | 126 | 157 | 103 | 360 | 390 | 395 |

| Average talk time (MM.SS) | 1.01 | 1.04 | 1.01 | 1.01 | 1.03 | 1.05 | 1.05 | 1.06 | 1.01 | 1.03 | 1.04 | 1.03 |