Management Discussion and Analysis

Social and Environmental Capital

DFCC Bank is committed to achieving the Sustainable Development Goals (SDGs) outlined by the United Nations to build a more prosperous, equitable, and sustainable world. Several SDGs have been addressed by DFCC Bank through the initiatives outlined in this section.

Living in a world with finite resources, we have a responsibility of being exemplary corporate citizens committed to create social values through engaging in sustainable businesses. We have endorsed the UN SDGs in our operations and carry out comprehensive programmes aimed at social development, environmental preservation, and community upliftment. At DFCC, we have created a culture that drives our employees to engage in CSR activities with great enthusiasm.

“Samata English”

“Samata English” is an initiative to teach Spoken English and equip and empower youth with basic English knowledge requirements to enter into the workforce. The project consists of practical activities, presentations, skills development and tutorials in classrooms with modern facilities.

“Samata English”was launched as a pilot in April 2017 in Gampaha and Kalutara areas. During July to October 2019, the programme was carried out in Jaffna, Polonnaruwa, Ampara, and Ratnapura areas for youth aged 18-25. Partnering with Gateway Language Centre, 112 students were selected to enroll for the course after completing an initial assessment. Upon completing the three-month course 99 students scored over 50 marks, indicating how much the course has helped to improve their spoken English skills. Gateway Language Centre conducted the final assessment and the students also received a certification from the Colombo Academy of Language Skills and Dramatic Art (CALSDA).

Furthermore, upon successful completion of the third edition of the “Samata English”, the top eight achievers across the regions will be given the opportunity to join the Bank as interns, creating opportunities for them to apply their knowledge, gain work experience, and develop their skills.

“SahayaHamuwa”

DFCC Bank initiated a special series of workshops in 2017, named “DFCC SahayaHamuwa” to nurture the growth of the micro, small and medium enterprises (MSMEs) in Sri Lanka. The primary focus of these programmes is to increase the financial literacy and financial management abilities of the MSMEs in addition to the financial services offered, so as to uplift the rural economies and regional development.

The Government has also identified the MSME sector as an important strategic sector in its overall policy objectives. CBSL has supported this agenda in their implemented policies to boost this sector through various technical and financial assistance.

A total of 55 workshops were held by end December 2019, engaging over 7,500 entrepreneurs. Out of this, 18 workshops were conducted during 2019 with a participation of 3,000 entrepreneurs. Specialist and renowned guest speakers participated in these events and held active questions and answer sessions on all key aspects of financial management. The Bank has spent approximately LKR 1.9 Mn for the programmes conducted from January 2019 to December 2019.

Promoting reusable bags

In 2019, the Bank gave 10,000 foldable reusable bags to customers and 2,000 bags to staff to commemorate the World Environment Day. These 12,000 reusable bags will reduce the use of plastic bags by approximately 5 Mn over two years.

Waste management

For the second consecutive year, a Clean-Up Day was organised on 22 June. In addition to the Head Office and the Office at W A D Ramanayake Mawatha, the Clean-Up Day was extended to Nawala Office and a few selected branches.

Active participation of staff on this day resulted in removal of many unwanted items leading to cleaner and spacious work areas. Sustainability Unit also made arrangements to collect e-Waste and discarded plastic on this day at Head Office, the Office at W A D Ramanayake Mawatha, and Nawala buildings, both from the Bank and from employees. The collected e-Waste and plastic was given to Central Environment Authority (CEA) approved recycling companies.

The Bank continued to discard all its e-Waste through a CEA approved e-Waste recycling company. In addition, facilities have also been made at Head Office for staff to bring e-Waste for disposal on a continuous basis. The Bank also has an agreement with a paper recycling company to collect all discarded/used paper in the three main buildings of the Bank.

Initiatives to reduce single-use plastic

- Discontinue of issuance of plastic covers for debit cards

- Discontinue of plastic water bottles for internal use/functions

- Encouraging staff to minimise single-use plastic through regular email messages and articles in the internal newsletter and holding a “No Single-Use Plastic Day” as a Sustainability activity on a Dress-Down Day

Initiatives to reduce paper, electricity, water, etc.

- Promotion of e-Banking, e-Statements, SMS alerts during the year

- Continuing the practice of sending e-Greeting Cards instead of printed cards

- Default setting of all printers has been set for double-side printing to reduce paper usage

- Notices placed in meeting rooms, lunch rooms, wash rooms etc. reminding staff to switch-off lights when not in use, to use less paper napkins, etc.

- Making mandatory to reuse envelopes for internal purposes

- One sided paper to be used before using new paper for internal use

- Introducing additional computer monitors for approximately 250 workstations in Operations and Credit Administration, resulting in reduced use of paper

Tree planting campaign

The commemorative staff tree planting campaign was continued for the third consecutive year by the Sustainability Unit, with planting of 7,000 trees during 2019. More than 25,000 trees have been planted from 2017 in different locations in Sri Lanka.

All staff and their families are invited for these campaigns. Special invitations are sent to staff celebrating their birthdays. E-certificates are sent after the event with a Google Map link of the location of the tree planting site.

The Bank makes arrangements with the institutions which own the land or a third party to carry out maintenance after planting. Regular site visits are made to ensure that proper maintenance has been carried out.

Beach clean-up campaigns

In January 2019, a beach cleaning campaign was held in Hikkaduwa. Another beach cleaning campaign was held in September 2019 at Mount Lavinia with the participation of many staff members and their families, including both the CEO and the DCEO.

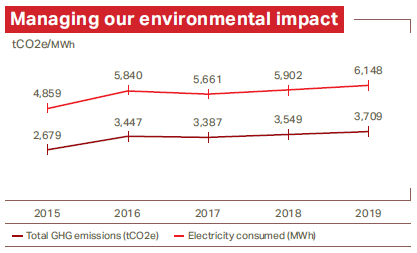

GHG Emissions

DFCC Bank is committed to making progress in reducing greenhouse gas emissions from our operations that help mitigate climate change. It is consistent with our strategy ensure environmental and social sustainability. For the sixth consecutive year, we are reporting our greenhouse gas (GHG) emissions on a voluntary basis. The physical boundary remains the same as in the previous years which is “DFCC Banking Business”.

As before, our calculations are based on the WBCSD/WRI Greenhouse Gas Protocol Corporate Standard and the most recent versions of applicable Calculation Tools. Our reporting under Scopes 1 and 2 is complete except for fugitive emissions from air conditioning plants, which are relatively insignificant. Reporting on Scope 3, which is optional, is selective based on significance and data availability.

Carbon footprint

| Scope | Source | GHG emissions | |||||

| 2019 | 2018 | 2017 | |||||

| tCO2e | % | tCO2e | % | tCO2e | % | ||

| Scope1 (direct) | Stationary combustion | 0.54 | 0.01 | 2.54 | 0.07 | 5.22 | 0.15 |

| Mobile combustion | 240.14 | 6.47 | 199.73 | 5.63 | 172.80 | 5.10 | |

| Total Scope 1 | 240.68 | 6.48 | 202.27 | 5.70 | 178.01 | 5.26 | |

| Scope 2 (indirect) | Purchased electricity (CEB) | 1,038.58 | 28 | 1,063.33 | 29.96 | 1,040.40 | 30.71 |

| Total Scopes 1 and 2 | 1,279.26 | 34.48 | 1,265.60 | 35.66 | 1,218.40 | 35.97 | |

| Scope 3 (indirect) | Stationary combustion | 97.34 | 2.68 | 104.57 | 2.95 | 91.27 | 2.69 |

| Purchased electricity (CEB) | 2,293.81 | 61.48 | 2,135.71 | 60.17 | 2,028.08 | 59.87 | |

| Employee air travel | 38.96 | 1.05 | 43.51 | 1.23 | 49.69 | 1.47 | |

| Total Scope 3 | 2430.11 | 65.21 | 2,283.79 | 64.35 | 2,169.04 | 64.03 | |

| Total Scopes 1, 2 and 3 | 3709.37 | 100.00 | 3,549.39 | 100.0 | 3,387.44 | 100.0 | |

Note: Totals may not tally exactly due to rounding

The total GHG emissions during the period under review amounted to 3709 tonnes carbon dioxide equivalent (tCO2e), an increase of 4.5% over the previous year.

Indirect GHG emissions from purchased electricity was by far the single largest contributor, accounting for 28% of the total in respect of Bank-owned premises (2018: 30%) and another 61.48% of the total in respect of rented premises (2018: 60.17%), bringing its total share to 90.58% (2018: 89.48%).

Given the nature of our business, the relatively high proportion of electricity in our total GHG emissions is to be expected.

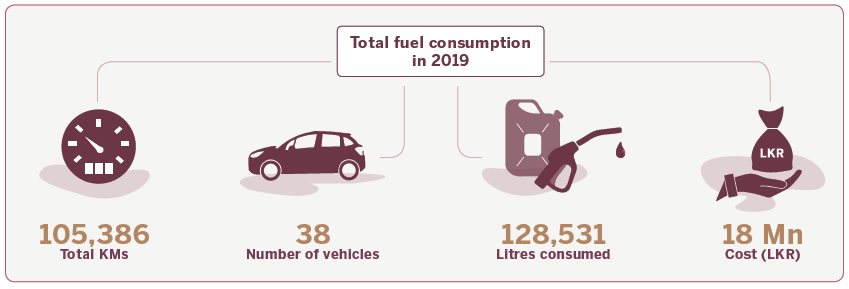

Fuel consumption

| Location |

Number of vehicles |

Litres consumed |

Total Kms |

Cost (LKR) |

| Head Office | 24 | 84,347 | 603,407 | 11,801,042.65 |

| Branches | 7 | 27,271 | 282,745 | 3,574,064.72 |

| Regional Branches | 7 | 16,913 | 167,713 | 2,670,356.47 |

| Total | 38 | 128,531 | 1,053,865 | 18,045,463.84 |

Social and Environmental Management System (SEMS)

Development projects have substantial impact on the society and environment. Our Social and Environmental impacts tend to be indirect, arising from providing financial services to projects. There are some projects that may negatively affect the environment, as well as expose the Bank to several risks, such as liability, financial, reputational, credit, and market.

The SEMS is implemented through the Sustainability Unit to ensure that the projects funded by the Bank meet the required environmental and social regulations on a continuous basis. The Bank also gives prominence to financing of green initiatives, such as renewable energy projects.

Sustainable Banking Principles (SBPs)

DFCC Bank is a signatory to eleven Sustainable Banking Principles (SBPs) promoted by Sri Lanka Banks’ Association (SLBA) under the “Sustainable Banking Initiative” (SBI). The Bank was actively involved in the SBI, with the Bank’s Head of Sustainability being a member of the “Core Team” of seven bankers responsible for implementation of the SBPs across all banks.

Management subcommittee on sustainability

The Management subcommittee on sustainability was established in December 2018 by CEO consisting of a cross functional management team, which provided directions to the Sustainability Unit on sustainability activities to be undertaken by the Bank during the year. This committee met on a regular basis under the presence and guidance of the CEO. AVP – Sustainability acts as the Convener/ Secretary to this committee.

Recognitions in 2019

- DFCC Bank received a Merit Award at the Association of Development Financing Institutions in Asia and the Pacific (ADFIAP) Awards Night held in Oman on 20 February 2019. The award was given under the “Outstanding Development Project Awards, Category 2 Environmental Development” for DFCC Bank’s project, “Funding the Installation of Rooftop Solar Systems of Large Rooftop Owners”

- DFCC Bank was awarded a Certificate of Merit for “Outstanding Sustainable Project Financing” at the Global Sustainable Finance Awards 2019 in Karlsruhe, Germany. This was to recognise success in financing Municipal Solid Waste to Energy Projects.